20+ pay off my mortgage

So paying one point might lower the interest rate on a 150000 refinance from 3 to 275 at 1500 upfront. A basis point is equivalent to 0.

5 Ways To Pay Off Your Mortgage Early Pros Cons

Common loan terms are 15 20 and 30 years.

. The longer you take to pay off the loan the smaller each monthly. Web If paying off your mortgage early is right for you here are some strategies to do it. Web How long your loan lastsYou can choose the amount of time youll take to pay off your mortgagetypically 10 15 20 or 30 years.

Not sure whether to cut my debt or invest in cashflow. And one point costs 1 of the loans total amount. One way of paying off your mortgage earlier than the term of your mortgage is to make 13 payments per year instead of 12.

Web Based on our example above of the 220000 loan that 100 in lunch money will help you pay off your mortgage almost five years ahead of schedule and save you over 27000 in interest. Web One way to pay off your mortgage early is by making larger monthly payments. Web Here are a few more creative strategies for paying off your mortgage early.

Biweekly mortgage payments The first way. Pay extra principal each year. If you refinance into a mortgage that needs to be paid over a shorter period of time.

However by putting 20 or more down youll take out a smaller loan and you wont be required to. I have 28 more years to go Rental property can generate me 10-20 return annually. Under the Income and Assets tests Jenny is now eligible for an increased part Age Pension of 13039 per annum or 502 per fortnight as the value of Jennys assessable assets has reduced.

Conforming fixed-rate estimated monthly payment and APR example. With a smaller down payment you may be required to pay private mortgage insurance PMI on a conventional loan. Now lets say you invested that extra 188 every month instead and you.

Web Once the equity in your property increases to 20 you can stop paying mortgage insurance unless you have an FHA loan. Some people use an annual bonus or tax refund to put extra money toward their mortgage. Refinance to a shorter term.

Downsides to paying off your mortgage early. Web The original fixed length of time usually expressed in years that a borrower agrees to pay on a mortgage loan until it is paid in full. Cant quite spare a whole 100 from your food budget.

Web 5 ways to pay off your mortgage early 1. Make extra payments There are two ways you can make extra mortgage payments to accelerate the payoff process. If this borrower can refinance to a new 20-year loan with the same principal at a 4 interest rate the monthly payment will drop 10795 from 131991 to.

If you are paying off your loan early you may have to pay a pre-payment penalty. Web Make One Extra Payment Per Year. Make extra principal payments.

Although its a myth that a 20 down payment is required to obtain a loan keep in mind that the higher your down payment the lower your monthly payment. Web For example a borrower holds a mortgage at a 5 interest rate with 200000 and 20 years remaining. Original Loan Amount The original amount borrowed from.

Web In some cases the lender may allow you to pay up to 20 percent of your principal balance before prompting a penalty fee. One way to get started with making extra mortgage payments is to set up a. It might be your.

Recast your mortgage instead of refinancing. Web Pay 948 a month188 moreand youll pay off the mortgage in 20 years and youd save 46000 in interest. Web Some loans like VA loans and some USDA loans allow zero down.

But how much more should you pay. 370000 530000 160000 mortgage balance Bank. The longer the time horizon the less youll pay per month.

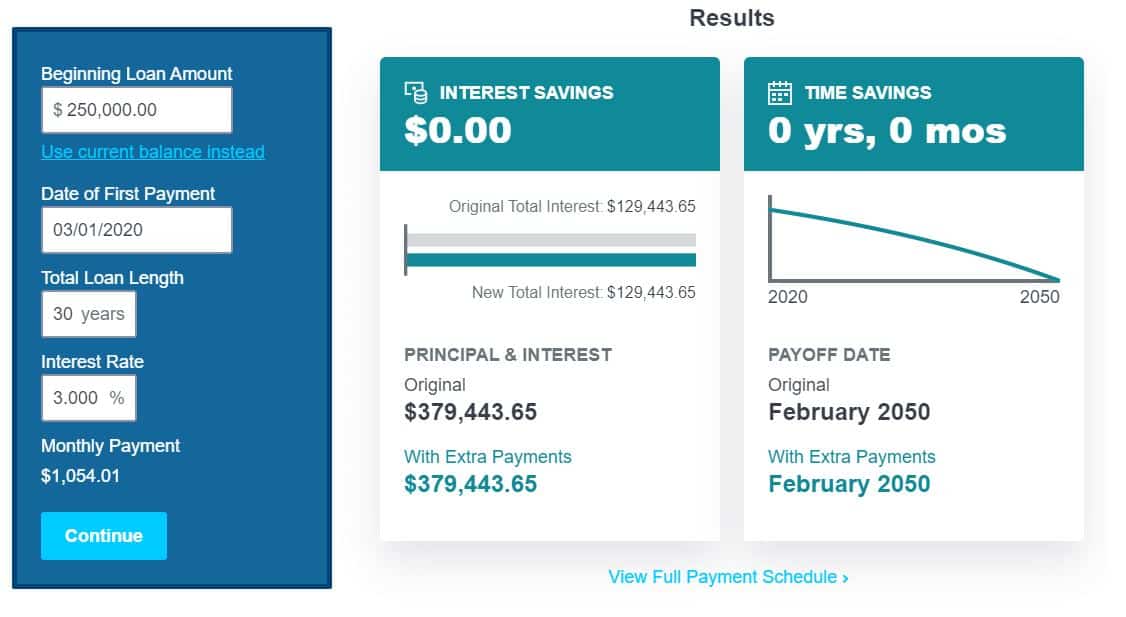

Web Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments. For a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week ago. Penalties are costly and unnecessary so avoid it by knowing your penalty terms.

Web Assuming you have a 200000 30-year mortgage at a 4 interest rate youd need to pay about an extra 500 a month toward your principal to drop your repayment period from 30 to about 15. A 20 down payment also allows you to avoid paying private mortgage insurance on your loan. Web Mortgage is based on a 30yr loan at 385.

NerdWallets early mortgage payoff calculator figures it out for you. If the down payment is less than 20 mortgage insurance may be required which could increase the monthly payment and the APR. The payoff amount may also include other fees you have incurred and have not yet paid.

You can add in the extra payment whenever you want throughout the year and continue to make those regular monthly payments as well. A 225000 loan amount with a 30-year term at an interest rate of 3875 with a down payment of 20 would result in an estimated. Web How to Pay Off Your Mortgage Faster Pay extra principal each month.

Once prepayment penalty is out of the way you can start making extra payments on your loan. Web The annual percentage rate APR calculation assumes a 464000 loan with a 25 down payment and borrower-paid finance charges of 0862 of the loan amount plus origination fees if applicable. Refinance to a lower.

Web 30-year fixed-rate mortgages. You decide to increase your monthly payment by 1000. Web You have a remaining balance of 350000 on your current home on a 30-year fixed rate mortgage.

Even small sacrifices can go a long way to help pay off your mortgage early. This can be a relatively painless way to shrink your mortgage faster. Web In general each point you pay lowers your interest rate on your mortgage by 025.

Web Conventional loans let you cancel PMI when youve paid off 20 of the loans original balance. Web Your payoff amount also includes the payment of any interest you owe through the day you intend to pay off your loan. You can make an extra principal payment every month once a year or.

Web Before you even get a mortgage you can prepare to pay it off early by making a 20 down payment on your new home. With that additional principal payment every month you could pay off your home nearly 16 years faster and save almost 156000 in interest.

Should You Pay Off Your Mortgage Money For The Rest Of Us

How I Paid Off My Mortgage In 2 Years My Personal Method Michael Saves

Should You Pay Off Your Mortgage Early Moneyunder30

Pay Off Your Mortgage In 3 Years The 4 Step System That Will Save You Years And Thousands In Interest Payments Kindle Edition By Blankenstein Eric Arts Photography Kindle Ebooks Amazon Com

Mortgage Payoff Calculator Ramsey

Pay Off My Mortgage Loan Early Or Continue To Make Payments

How To Pay Off Your Mortgage Faster The Truth Youtube

Should I Payoff My Mortgage Early Greenbush Financial Group

How To Pay Off Your Mortgage In 5 7 Years Build Wealth Live Debt Free Youtube

Four Ways You Can Pay Off Your Home Mortgage Faster

How To Pay Off A Mortgage Early

Selling A House With A Mortgage Bankrate

17 Actionable Ways To Pay Off Your Mortgage In 5 Years Arrest Your Debt

:max_bytes(150000):strip_icc()/50-30-20budgetingrulecustomillustration-9973713c9be846c1b25b7bf372b4818d.png)

The 50 30 20 Rule Of Thumb For Budgeting

17 Actionable Ways To Pay Off Your Mortgage In 5 Years Arrest Your Debt

How To Pay Off Your Mortgage In 5 Years Youtube

Should You Invest Your Money Or Use It To Prepay Home Loan The Economic Times